What To Consider When Refinancing

"When interest rates drop, there's often a surge in home refinancing. A low-interest-rate environment is bad for savers, but it can be great for those interested in refinancing a home or buying one. The good news is that interest rates are still at low levels.

If you're interested in refinancing a home, here are some tips and some things to consider..."

Image by Johann Jaritz via Wikimedia Commons.

Pay Attention To Your Credit

"It's a good time to think about the ins and outs of buying a house. One factor that can have a big ripple effect on your ability to qualify for a mortgage is your credit card habits.

Not sure how plastic plays a role in your homeownership plans? Let's dig into the details..."

Image by Sprinno via Wikimedia Commons.

What To Do Before Buying A Home

The spring homebuying season is in full bloom, and odds are, if you're reading this, you may be thinking it's time to finally start looking for your first house. But before you dive in, it’s important to get your finances organized and know what you can afford. Here’s a checklist to get you moving toward this major purchase..."

Image by Kuohatti via Wikimedia Commons.

Why It Is A Good Time To Purchase A Home

"If you're wondering whether this summer is a smart time to buy a home, then let me cut to the chase. Thanks to still-historically low mortgage rates, housing may never again be as affordable as it is right now.

At present, the interest rate on a 30-year fixed rate mortgage is 4.19%. That's the cheapest they've been all year, and they even recently dipped below half the long-run average of 8.52%..."

Image by Sjleads2 via Wikimedia Commons.

Avoiding Homeownership Barriers

"Think you can’t buy a home? Think again.

In November 2013, Trulia surveyed renters who want to buy a home, asking about the obstacles that hindered their goal. The survey respondents cited several barriers to buying a home, all of which are listed below.

Let’s explore these obstacles to homeownership, and look at how you can overcome each of them..."

Image by MrHarman via Wikimedia Commons.

How To Perfect Applying For A Mortgage

“If you are planning to buy a home anytime soon, you'll most likely need to apply for a mortgage. Unfortunately, mortgages can be tougher to get these days than many people think.

Credit standards have relaxed a bit, but are still high on a historic basis. For example, the average FICO score for an approved conventional mortgage is 755, and the average score of those applicants who get denied is 724, which is considered to be a very good credit score…”

Image by Ljh3822 via Wikimedia Commons.

Home Price Appreciation Continues

The Case-Shiller Index increased 0.19% month-over-month and 10.8% year-over-year.

Home prices have increased the most in cities like Phoenix, Detroit, and San Francisco.

There hasn't been much growth in most Northeast, where judges must approve foreclosure.

Image via Twitter/ShillerFeeds

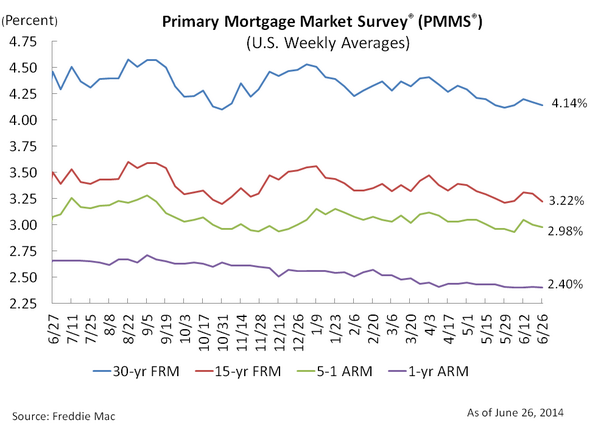

Fixed Mortgage Rates Are Lower Than Last Year

Freddie Mac released its Primary Mortgage Market Survey results.

According to the results, fixed mortgage rates are lower this week than they were at this time last year.

30-year fixed-rate mortgage averaged 4.14%, while it was at 4.46% at this time last year.

Image via Twitter/FreddieMac

Don’t Give In To Impulse

A study by Bankrate.com revealed that savings do not fluctuate with income. People typically spend what they make. This is due to impulse purchases.

Typical impulse purchases include lottery tickets, clothing, apps, larger food sizes, and games of chance. These purchases are usually not needed and they are instantly regretted.

Cutting down on some of these impulse purchases should increase your savings by a decent margin.

Image by Magnus D via Wikimedia Commons.

GDP Suffers Large Drop

The United States economy took a turn for the worse in the first quarter of 2014, falling 2.9%.

It is the first time the economy has shrunk since 2011, and it is the worst drop since 2009.

Job growth, however, remains at steady growth.

Image by Cbl62 via Wikimedia Commons.