Many Young Adults Living at Home

Since the start of the housing crisis, more and more young adults continue to live at home with their parents, citing financial reasons.

Between 1990 and 2006, the number of young adults living at home averaged 27 percent. In 2013, that number spiked to 31 percent.

Economists at CoreLogic call this group the "Renter Generation."

Image via Wikimedia Commons/SanibLemar

Signing Your Mortgage Docs: Don’t Be Afraid to Ask Questions

Filling out loan documents is a long and complicated process, and you'll be asked to sign lots of documents that you may not fully understand.

If this happens to you, don't be afraid to ask questions.

The complexity of the process is "not necessarily a bad thing," says LearnVest's Ellen Derick. "But you should know what it [all] means."

Image via flickr/401(k) 2012

Twitter’s NYC Headquarters Sell for $335 Million

The two-building complex that is home to Twitter Inc.'s New York City headquarters was sold to publicly traded landlord New York REIT, Inc., on Thursday for $335 million.

The price works out to about $1,188 per square foot.

The property contains one 12-story building and an adjacent six-story, mixed-use building. In all, the complex has 282,000 square feet of rentable office space.

Image via flickr/rexboggs5

Refinancing Boom Comes to an End

Freddie Mac officially declared this week that the refinancing boom is over.

They called the official end "when the share of mortgages originated for refinancing fell below 50 percent for the first time since the third quarter of 2008," according to Mortgage News Daily.

The boom marked the longest stretch of refinancing in the 24 years since the company began keeping track.

Image via flickr/lendingmemo

Homeownership at 19-Year Low

As the second quarter of 2014 comes to an end, homeownership is at a 19-year low, falling to 64.8 percent. That is down .1 percent from the first quarter of this year, and .3 points lower than it was this time last year.

Homeownership was at its highest most recently in 2004, when it peaked at 69.4 percent.

Image via Wikimedia Commons/SanjibLemar

Mutli-Million Dollar Mortgages Seeing a Surge

While many first-time home buyers are struggling to get approved for modest-sized mortgages, banks are seeing a major increase in the number of multi-million dollar loan requests coming through their doors.

“High-net-worth borrowers don’t have to borrow," Bank of New York Mellon Corp. managing director Erin Gorman told bloomberg.com. "They choose to, so they’re very strategic about what, why, and when they borrow.”

They're borrowing now while interest rates are low instead of liquidating their assets in a stock market that has seen a seven percent gain this year.

Image via flickr/Atwater Village Newbie

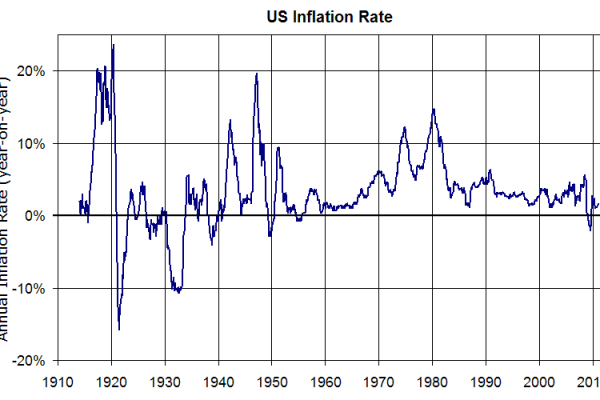

Mortgage is Cheapest Way to Borrow

No one loves carrying debt, but if you have to do it, a mortgage is usually one of the cheapest ways to go about it.

Especially now with interest rates at historical lows, plus the fact that any interest incurred is tax-deductible, no other loans come close.

According to the Wall Street Journal, "If you have other debt, you probably could lower your borrowing costs by paying off those loans and instead carrying a larger mortgage."

Image via flickr/stockmonkeys.com

Zillow and Trulia Rumored to Merge

Online house hunting sites Zillow and Trulia may be pairing up, which would create one giant listing site of homes for sale and could potentially make real estate brokers irrelevant. News of the rumors sent stocks for both sites soaring on Friday, while brokers have begun to fear for the state of their jobs in the changing market.

Neither site has commented on the rumors.

Images via Wikimedia Commons/Jmabel and Wikimedia Commons/Awilkinson4

Don’t Be Afraid to Shop for Lenders

To ensure the best rate and the best home buying experience, it is important to shop around for the right lender.

The best approach is to find several options and provide all of them with the same pertinent financial information. Once they’ve all provided you with quotes, you can compare to see who has the best rates for you. Then, call or meet with them to decide which one you feel most comfortable with.

Image via flickr/401(K) 2012

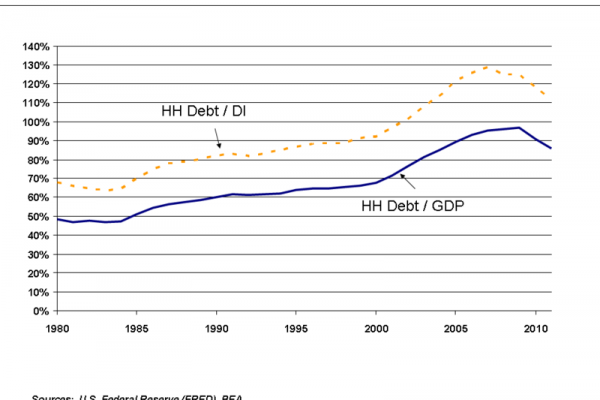

Work on Debt-to-Income Ratio for Best Mortgage Rates

When taking out a loan like a mortgage, your potential lender wants to know how much you currently owe versus how much you make.

To increase your chances of securing the best rate possible, it is wise to pay off as much debt as possible beforehand. Having less debt on your hands makes you a more desirable candidate.

Image via flickr/Alan Cleaver