MasterCard Extending Zero-Liability

After security breaches like one of the magnitude of the Target scandal, MasterCard is making strides to make its cardholders feel safer.

The credit and debit card company is extending its zero-liability protection to all PIN-based and ATM transactions, taking effect in October. The protection currently only protects transactions made by signature, leaving a cardholder vulnerable if a thief gets a hold of his or her personal identification number.

Image via Twitter/MasterCard

No Rush To Raise Rates

President of the Federal Reserve Bank of Atlanta Dennis Lockhart says that he sees the economy rebounding after its rough start to 2014.

Lockhart says that the Federal Reserve System needs to have patience with the labor markets and increasing rates, although many Fed members are concerned about the market tightening.

Image via Twitter/AtlantaFed

Goldman Sachs and JPMorgan Sued

Goldman Sachs Group Inc and JPMorgan Chase & Co have been accused of conspiring to manipulate the United States price of zinc.

A representative for Goldman Sachs says that the company is "vigorously" contesting the lawsuit, while JPMorgan declined to comment.

Image by Youngking11 via Wikimedia Commons.

United States Has Third Consecutive Economic Rise

Despite a slow start in 2014, the United States economy has seen steady growth over the past three months.

The economy is expected to continue to expand and may even grow at a larger rate through the second half of 2014.

Image via Twitter/CEDUpdate

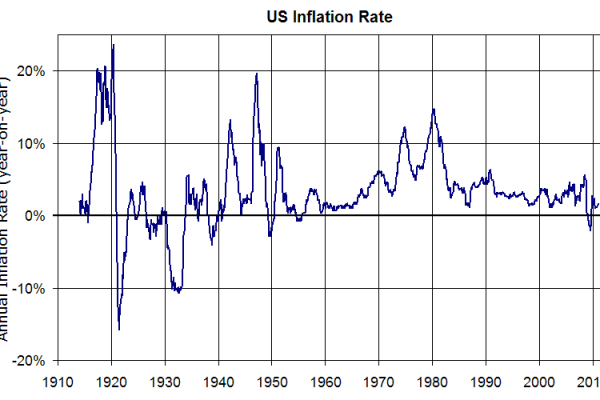

Inflation May Be On The Rise

According to a poll of economists, United States inflation will reach two percent by the end of 2014.

Economists have increased their forecasts from a month ago for inflation and job growth and hiring.

Interest rates are not expected to rise until later next year.

Image by MediaPhoto.Org via Wikimedia Commons.

San Francisco Is Most Expensive City In U.S. For Home Buyers

According to a report released by HSH, San Francisco is the most expensive city in the United States for home buyers.

San Francisco homes have a median home price of $679,000 with median monthly payments of $3,199.69. The report calculates that a person would need to make at least $137,129.55 per year to live in San Francisco.

Second on the list was San Diego with a median home price of $483,000, and a salary of $98,534.22 per year needed to live there.

Image via Wikimedia Commons.

Fed Does Not Need To Shrink Balance Sheet

Chairman Ben Bernanke says that the Federal Reserve does not need to reduce its $4 trillion balance sheet.

Bernanke says that the Fed has worked to be able to "raise rates at the appropriate time."

Trillions of dollars were spent under Bernanke in an effort to boost the United States economy.

Image via Twitter/FederalReserve

Hilary Clinton Advocates Upward Mobility

Hilary Clinton gave a speech to the New America Foundation recently, touting economic growth.

The potential 2016 Democratic candidate referenced her husband, Bill Clinton's time in office to demonstrate job creation and growth.

Clinton also complimented Barack Obama's "work and strong leadership" in turning the economy around.

Image by Chatham House via Wikimedia Commons.

Higher Minimum Wages Not Hurting Job Growth

According to data released by Paychex and IHS, there is no clear evidence to prove that a raised minimum wage kills jobs. In fact, the opposite trend is occurring.

San Francisco, which has one of the highest minimum wages in the United States at $10.74 an hour, has faster job growth than any other major U.S. city. Washington is another example of this, with the highest state minimum wage, but the quickest job growth acceleration.

Image by Annette Bernhardt via Wikimedia Commons.

Inflation Pressure Increasing

According to the United States Labor Department, producer price index rose 0.6% . This is the largest increase in nearly two years.

The increase in PPI is an indicator of pressure on price, meaning inflation may occur if the trend continues.

Image by Lawrencekhoo via Wikimedia Commons.