Home Buying Season Officially ‘In Full Swing’

Ellie Mae released its latest Origination Insight Report on Thursday and revealed that “home buying season is in full swing.”

According to the newest data from May, purchase volume took a 58 percent share of all mortgage originations, which was up from 52 percent in April.

Of note, however, is that May’s share fell far below the 66 percent share seen in May 2014, which Ellie Mae president and CEO Jonathan Corr attributes to the lower mortgage rates leading to higher refinancing volumes.

Image via flickr/Mark Moz

Rent Inflation Continues, No Relief in Sight

As rent prices continue to skyrocket, there appears to be no relief in sight.

According to the most recent data released on Thursday, consumer housing costs are far outpacing price growth elsewhere in the economy, and landlords don’t seem to want to let up any time soon.

The good news for renters, however, is that we are also starting to see some signs that wage growth is beginning to pick up, which should help offset the rising cost of housing.

Image via flickr/Charleston’s TheDigitel

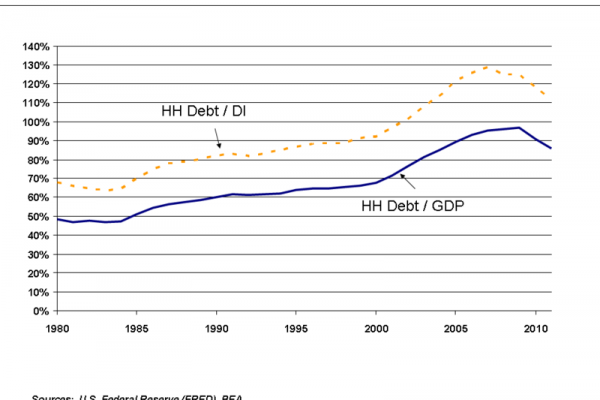

Consumer Debt Defaults Hit New Lows

Good news for consumers: Households nationwide are getting better at keeping their debts in check.

According to the latest S&P/Experian Consumer Credit Default Indices – which track the rate at which consumers fall behind on their debt – Americans are now defaulting less and less on their loan commitments than ever before.

“The drop in defaults comes as a strong job market has helped boost incomes, helping consumers better manage monthly debt payments,” CNBC reporter John W. Schoen explained. “Historically low interest rates have also helped keep the cost of those monthly payments relatively manageable.”

Image via flickr/Simon Cunningham

NJ Senator Menendez Proposes Bill to Help Homeowners Nationwide Avoid Foreclosure

New Jersey Senator Robert Menendez proposed a brand new bill on Tuesday that would aim to help homeowners nationwide avoid going into foreclosure.

Specifically aimed at individuals and families across the country who owe more than their house is worth, the bill seeks to create a program in which banks would reduce the mortgage principal for eligible homeowners.

"My bill aims to give homeowners the break they need by working with banks to find acceptable solutions for everyone,” Menendez said. “Not only can we help families stay in their homes, we can mitigate the impact zombie foreclosures have on our communities and our economy."

Image via flickr/www.GlynLowe.com

New Study Shows Adding Teen Drivers Can Double a Family’s Car Insurance Premiums

Bad news for the parents of teenagers: A new study conducted by InsuranceQuotes.com, which was released on Monday, found that the monthly premium a married couple pays for car insurance can jump by as much as 80 percent once a teen driver is added to the policy.

The good news, however, is that there is some relief in sight for the families of young drivers who meet certain criteria.

“I’ve seen discounts as high as 25 percent for students who maintain at least a B average in high school or college,” Laura Adams, senior analyst for InsuranceQuotes.com said in a statement. “Students and their parents need to proactively request this discount.”

Image via flickr/State Farm

CNBC: The ‘Great Rotation’ Has Hit Wall Street

CNBC reported over the weekend that the highly anticipated “Great Rotation” may finally have hit Wall Street.

According to the news site, the “rotation” phenomenon is marked by a “massive shift of money out of bonds and into stocks.”

In 2014, the S&P 500 index rose right alongside bond prices, but last week alone, investors removed nearly $6 billion out of global funds – marking the largest outflow in nearly two years.

According to Jim Iuorio, a Chicago-based trader with TJM Institutional Services, the bond and equity markets are now taking on “a whole new personality completely.”

Image via flickr/Sue Waters

Housing Market on Track for Best Year Since 2006

According to a new report published by Realtor.com on Thursday, the housing market is currently on track to have its best year since 2006.

As we reach the midpoint of 2015, the site credits job growth for “powering the surge in demand for homes,” as more than 1 million jobs have been created over the last 12 months for 25- to 34-year-olds alone. And that age group, of course, is when most Americans buy their first home.

Unlike 2006, however, reporter Jonathan Smoke predicts that this year’s peak is not a bubble – and that’s a good thing.

Image via flickr/James Thompson

Red Car Auto Insurance Myth Debunked

There’s probably a pretty good chance you’ve heard the myth that red cars cost more to insure than vehicles of any other color.

“For years there has been a notion that color plays a significant part in calculating insurance premium costs, many people believing that red cars cost more to insure because they are linked to aggressive driving or speeding,” a rep for Insurance Information Institute told NerdWallet.com.

As it turns out, however, that rumor is completely false.

Instead, insurance rates are based solely on the make, model and year of your car, as well as its engine size, body type and safety features.

Image via flickr/Jonathan Rolande

Consumer Housing Outlook on the Rise

With the recent improvement in employment statistics, potential homebuyers are beginning to view the housing market with a more positive outlook.

As reported by Mortgage News Daily on Tuesday, average hourly earnings and personal income are on the rise, with nearly 28 percent of respondents in Fannie Mae’s May National Housing Survey reporting a significant increasing in their household income in the last months.

As a result, the number of respondents who feel it is now a good time to buy a home jumped to 66 percent this month, up from 63 percent in April. In addition, 49 percent believe it is a good time to sell, up from 46 percent last month.

Image via flickr/woodleywonderworks

CNN Reveals Top 10 Markets with Overpriced Homes

Potential homebuyers, beware!

On Monday, CNN Money released the list of the top 10 markets in the U.S. with overpriced homes, and yours just may be on the list.

According to the site, Denver tops the list, while Boston, Washington, D.C., Pittsburgh, San Francisco, Honolulu, San Jose, Louisville, Colorado Springs and San Diego follow closely behind.

"Housing prices have moved up so fast in the last few years, especially those priced just above the median," said James Paine, managing partner at West Realty Advisors, of Pittsburgh in particular. As for San Fran, “It has the highest median home price in the entire country and the lowest affordability.”

Image via flickr/Larry Johnson