CNBC reported on Tuesday that homeownership rates continue to decline to historic lows as rentals soar.

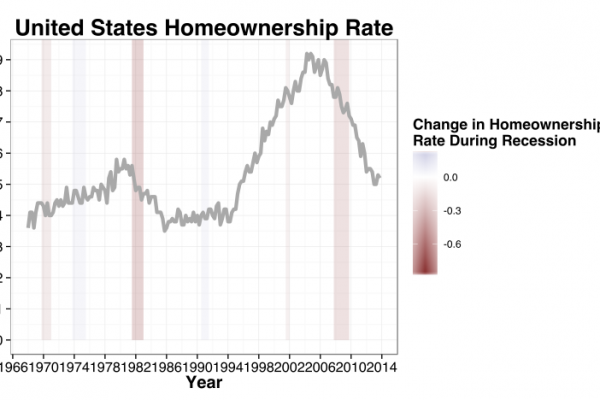

According to the news source, the homeownership rate has dropped to 63.4 percent, which is the lowest number we’ve seen since 1967.

Rental prices, meanwhile – as well as the demand for rental properties – continue to skyrocket.

“Our results for the second quarter and year to date exceeded our original outlook,” noted Tim Naughton, chairman and CEO of AvalonBay, one of the nation’s largest apartment REITs, in the company’s second-quarter earnings release out Monday. “For the balance of the year, we expect accelerating apartment demand to support stronger performance across our business.”

Image via wikimedia/Bhtucker