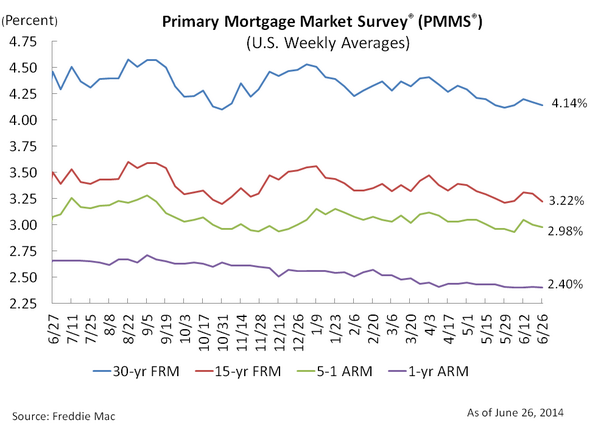

“When interest rates drop, there’s often a surge in home refinancing. A low-interest-rate environment is bad for savers, but it can be great for those interested in refinancing a home or buying one. The good news is that interest rates are still at low levels.

If you’re interested in refinancing a home, here are some tips and some things to consider…”

Image by Johann Jaritz via Wikimedia Commons.