Manhattan Real Estate Hits New Price Record

The square-foot price of real estate in Manhattan hit a record high in the third quarter of 2015, rising to $1,497.

According to a report released by Douglas Elliman on Thursday, in addition to rising prices, New York City is also experiencing a tightening inventory as apartments continue to sell faster and with more frequent bidding wars – and there are no signs of letting up.

"Everything is selling fast, I don't see how there could be a bubble," said Howard Lorber, chairman of Douglas Elliman. "I think to some degree real estate follows the stock market, but people buy real estate to live in also, not just to invest in."

Image via flickr/Carlos Adampol Galindo

Prepayment Penalties Demystified

Perhaps you received an inheritance and want to pay off your mortgage. Or maybe you cleaned up your credit and want to refinance a not-so-favorable loan. These sound like easy adjustments, right? Well, that depends. Prepaying your loan could cost a good deal of money if you have a prepayment penalty in your contract.

Though it seems unfair, mortgage lenders have a reason for imposing prepayment penalties on some loans. Before you sign on the dotted line, find out what you need to know about these clauses and what to do if you have a prepayment penalty on your mortgage.

What is a Prepayment Penalty?

In a mortgage contract, a prepayment penalty clause says that a financial penalty can be imposed if a mortgage gets paid off within a certain time period. This prepayment could result from a refinance, large principal payment or even the sale of the home (which would pay off the mortgage). The penalty is usually based on a percentage of the balance that remained on the loan or a particular number of interest payments.

Mortgage lenders often talk about "soft" prepayment and "hard" prepayments. A "soft" prepayment penalty refers to a loan that gets paid off through a refinance. A "hard" prepayment penalty involves both a sale and a refinance. Both types of prepayments are subject to penalties According to the mortgage contract, both types of prepayments can incur penalties.

Why Impose Prepayment Penalties?

Mortgage lenders impose prepayment penalties because they stand to lose a good deal of interest rate money if a borrower pays the loan off before the agreed-upon time. They may have taken a risk on a borrower with less-than-stellar credit and impose prepayment penalties because sub-prime loans are regularly refinanced within a short time of the loan origination.

While a prepayment penalty is always an option for both parties, lenders have the option to refuse to write the loan without one if they feel they should be compensated for the financial risk.

Working with Prepayment Penalties

Many borrowers actually look for loans with prepayment penalties because they often result in a lower interest rate. A loan with a prepayment penalty could work well for a homeowner looking to lower monthly payments and stay in the home for several years without refinancing.

Prepayment penalties usually get smaller as time goes by and often disappear altogether after the loan has been held in good standing for five years. Most of the time, you can prepay up to 20% of the principal in one year without incurring a penalty, but this amount will vary from contract to contract.

Check your loan documents carefully for any prepayment penalties before you sign the agreement. If you find yourself with an unexpected prepayment penalty, grab your calculator and figure out if the payoff or refinance is worth the extra money you will have to pay. In some instances, it may be wise to wait.

Good luck! Refinancing could save you hundreds each month. Start Now!

Do You Qualify for the Making Home Affordable Program?

By Kat DeLong

Are your monthly mortgage payments increasing due to an unconventional loan? Is a job loss or frequent medical bills making it impossible for you to pay your mortgage every month? If so, the first step is to take a deep breath and find out if you qualify for relief with the government's Making Home Affordable Program.

As part of the stimulus plan, the program was introduced by President Obama on February 18, 2009 to help struggling borrowers keep their payments current and avoid foreclosure. There are two main parts to the Making Home Affordable Program: a modification program and a refinance program. Your circumstances will determine which part of the program is right for you, but let's take a look at each.

Making Home Affordable Modification Program

The modification program offers lenders $75 billion in incentives to help borrowers pay current interest rates plus points and fees. If you can no longer afford your Are your monthly mortgage payments increasing due to an unconventional loan? Is a job loss or frequent medical bills making it impossible for you to pay your mortgage every month? If so, the first step is to take a deep breath and find out if you qualify for relief with the government's Making Home Affordable Program.

As part of the stimulus plan, the program was introduced by President Obama on February 18, 2009 to help struggling borrowers keep their payments current and avoid foreclosure. There are two main parts to the Making Home Affordable Program: a modification program and a refinance program. Your circumstances will determine which part of the program is right for you, but let's take a look at each. mortgage payments but can answer yes to the following questions, you may qualify for the Making Home Affordable Modification Program:

- Are you using the home as your primary residence?

- Do you owe less than $729,750 on the first mortgage?

- Have experienced a hardship that increased your expenses, an increase in your payments or a reduction in your income?

- Did you get your first mortgage on or before January 1, 2009?

- Do you have a first mortgage payment (including interest, taxes, insurance and homeowners association dues) that is more than 31% of your gross monthly income?

Making Home Affordable Refinance Program

The refinance program allows borrowers who owe more than their home is worth to refinance to market rates, but it may not be used for a cash-out refinance.

If you can answer yes to the following questions, you may be eligible for this program:

- Are you current on your payments, meaning that you have not been more than 30 days late on a payment in the last 12 months?

- Are you refinancing a building with 1-4 units?

- Do you have a loan guaranteed by Fannie Mae or Freddie Mac?

- Do you owe less than 125% of the current value of your home on the first mortgage?

If you think you qualify for one of these programs, contact your loan servicer immediately. In the meantime, gather your tax returns, income statements, mortgage statements, credit card balances, balances you carry on other debts and a hardship affidavit if you apply for the modification program.

Important Notes

- Applying for either of these two programs is free, so beware of anyone charging fees for modifications or refinancing under this plan.

- The government is scheduled to end both programs in June of 2010. If you think you qualify, act now!

The Truth about the Truth in Lending Act

By Kat DeLong

When you sign up for a new credit card or buy a house, you are faced with pages and pages of small print - do you really read all of it? The answer is probably "no." Even though you may not go through the whole stack of paper as you sign here and initial there, some fine print should not get overlooked. Thanks to the Truth in Lending Act (TILA), the loan documents must contain the vital information you need

The TILA Defined

Originally passed by congress in 1968, the TILA is a uniform way for lenders to present the terms of a consumer loan so that borrowers can make informed choices and compare costs equally between lenders. This act covers both "closed ended" loans, such as a car loan or mortgage that you pay back over a specified period of time, and "open ended" loans, such as credit cards.

Material Disclosures

While the Truth in Lending Act covers necessary information, these five material disclosures must always be included:

- The Annual Percentage Rate (APR). This is the percentage listing of the cost of credit that includes all of the finance charges. This is different from the interest rate that is quoted elsewhere in the documents. When all of the charges are included, a loan with an interest rate of 17% may actually have an APR of 25%.

- Finance Charges. This is the dollar amount that is the cost of the credit over the life of the loan. This amount will include all interest, points and preparation fees.

- Amount Financed. This disclosed amount will take the principal amount of the loan and subtract finance charges. For example, if you finance $200,000 and carry five points ($10,000), the amount financed would be $190,000.

- Schedule of Payments. The schedule will tell you the day the payment is due and the dollar amount due for the life of the loan.

- Total of Payments. The total dollar amount that the loan will cost you as long as the scheduled payments are made on time.

New Provisions for the TILA

Recent changes to the TILA address some discrepancies found in so-called "higher-priced mortgage loans." These changes strengthened parts of the TILA relating to practices viewed as unfair or deceptive. They offer key protection for borrowers including ending the practice of lending money without considering the borrower's income or ability to repay the loan and put conditions on prepayment penalties.

Violations

Mortgages and Equity Loans: What’s the Difference?

By Kat DeLong

Mortgages, equity lines of credit, second mortgages - these terms are often tossed around by lenders, but do you know what they really mean? It may seem like Homebuying 101, but knowing the difference between these types of loans is a crucial part of making your first home purchase or improving the one you live in right now.

Types of Mortgage Loans

A mortgage is a loan secured by some sort of real estate - it can be your primary residence or a home you purchase for an investment. Once you get the loan from your lender, you pay it off in installments over a set period of time, usually 15, 20 or 30 years. While lenders write all kinds of loans, including reverse mortgages and those that have "balloon" payments, they can be divided into two basic types:

- Fixed Rate. A fixed rate mortgage gets the interest rate at the time the loan is written, so you pay the same amount of money every month for the life of the loan. These types of loans are the most common mortgages written today, and they have the safety of knowing that the payment amounts won't change. On the other hand, because the interest rate is fixed, even if rates drop, the payments will stay the same unless you refinance the mortgage. Rates for a fixed-rate loan may also run higher than other types of mortgages.

- Adjustable Rate. Also called an ARM, this type of loan starts with a lower interest rate and lower payments for an introductory period of time, but then "adjusts" periodically, usually causing an increase in payments. Adjustable rate loans often have a "cap," which limits how much the rate can increase during the life of the loan. These mortgages seem best for those who only plan to own the property for a short period of time.

Types of Equity Loans

Equity loans (also called second mortgages) are loans secured by the equity, or the amount the property is worth over and above the money owed on the mortgage. If your home is worth $200,000 and you owe $150,000 on your mortgage, you have $50,000 in equity.

You can get an equity loan as a lump-sum amount of money, and then make payments on the principal and interest of the whole amount, or you can get an equity line of credit. A line of credit is an approved amount of money that you can access by writing a check or using a credit card as you need it, so you only pay for that portion of the loan that you actually use. The payments for equity loans are based on the amount owed and the current interest rate, so they can fluctuate as the rates go up and down.

Despite what you might hear in the news, lenders are still writing mortgages and equity loans for borrowers who qualify. If you need money to buy a home or build that kitchen of your dreams, get started. RateMarketplace can help.

Many Renters Not Ready to Buy

By now, it’s no secret that the rental market nationwide is skyrocketing, with more people renting than ever before – and rental prices soaring to new heights.

But despite the rising costs, most tenants are largely satisfied to keep renting and have no plans to buy a home any time soon.

According to a new report released by Freddie Mac late last week, 55 percent of renters plan to continue doing so over the next three years, while the remaining 45 percent would consider buying in that time frame.

Image via flickr/Phil Sexton

Wells Fargo Adding More Car Loan Branches Nationwide

Wells Fargo revealed to Reuters on Tuesday that it has begun creating more branches devoted to car loans and financing for auto dealers as a way to increase its auto lending business in a relatively low-risk environment.

According to the news source, Wells Fargo currently operates 56 branches for car and dealer financing, with the most recent one having just opened in Cherry Hill, N.J.

“It’s a differentiator for us,” Dawn Martin Harp, head of dealer services, said. Wells Fargo’s chief executive John Shrewsberry, meanwhile, added that the sector is “providing a big opportunity because so many cars are being sold.”

Image via flickr/Prayitno

Continue to original source.

Image via Flickr/Ildar Sagdejev

New Report Uncovers Why Many Americans Wait to Buy First Home

According to a new report released by the Associated Press on Monday, Americans are waiting longer than ever before to buy their first homes – and it’s due to a shortage of cash and unsettled careers.

The news source – referencing data from Zillow – revealed that the typical first-time homebuyer now rents for six years before purchasing their first property. That number is up from 2.6 years in the early 1970s.

Millennials are "still very interested in buying a house, but they're delaying that decision," explained Svenja Gudell, chief economist at Zillow. "Once they start having kids, they begin looking for homes. We're also finding that – given how much rental rates are currently rising – a lot of folks are having a hard time saving for a down payment and qualifying for a mortgage."

Image via flickr/fr0ggy33

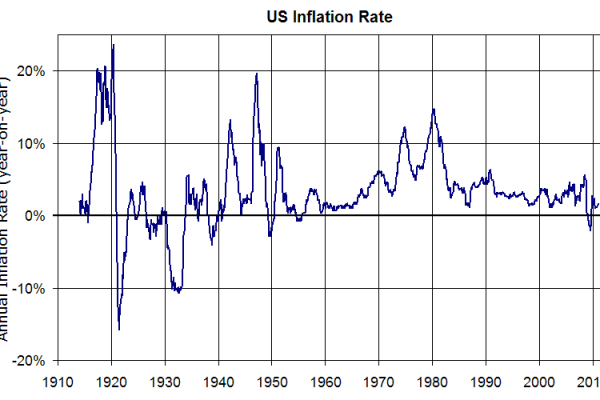

New Report Shows Where Inflation Is Most Prevalent

Although much of the country is currently enjoying a drop in gasoline prices and certain other commodities, inflation has most certainly not gone away.

According to CNBC, there are several areas where the cost of goods and services has skyrocketed recently, with construction prices leading the way.

“We forget about this (services) component but it is nearly two-thirds of producer costs,” said economist Joel Naroff. “Trade, transportation, warehousing and government services all posted gains. This portion of the economy should provide a base for inflation.”

Image via flickr/Simon Cunningham

Tenants Spending Record-High Shares of Income on Rent

As rent prices continue to increase nationwide, the Wall Street Journal confirmed on Thursday that tenants are now spending a higher share of their income on housing than ever before.

According to the paper, most renters can expect to pay at least 30 percent of their income on rent, which is the highest number we’ve seen since Zillow began collecting data in 1979.

“Our research found that unaffordable rents are making it hard for people to save for a down payment and retirement, and that people whose rent is unaffordable are more likely to skip out on their own health care,” said Svenja Gudell, Zillow’s chief economist.

Image via flickr/Juhan Sonin