Lessen the Strain of Student Loans

The average American household owes nearly $33,600 in student loan debt, which breaks down to about $387 per month with a 6.8% interest rate under a standard 10-year payment plan.

But it doesn't have to be as bad as it sounds. To lessen your monthly payments, consider joining a pay-as-you-earn program; sign up for an income-based repayment program; extend the timeframe for your loan repayment (though this will increase the amount of interest you pay over time); refinance and lower your interest rate; or defer your payments for up to three years. Also, if you're a teacher or a public sector employee, you may be eligible for special financing programs.

Image via Flickr/Simon Cunningham

How Mortgage Is Affected By Social Security

"Social Security is an invaluable benefit to millions of Americans. And what it means for those looking for a mortgage may surprise you.

The common myth

For years, mortgage giants Fannie Mae and Freddie Mac have allowed Social Security to count as income for those applying for a mortgage..."

Image by John Phelan via Wikimedia Commons.

How Much First-Time Buyers Should Save

"Singles, couples, families -- at some point almost everyone turns their financial attention to buying a home. But how much do we really need to save the first time out? How much is enough to handle the typically steep curve of down payments and closing costs?

When it comes to saving for a home, there are some helpful rules of thumb. But then, there are also alternatives for buyers who need a leg up.Let's look at the basics and some workarounds when considering approaches that first-time buyers can take to getting through the front door of their first house..."

Image by Garry Knight via Wikimedia Commons.

Considerations For Renting Property

"Many beginner or speculator-type real estate investors think that the crux of real estate investing is finding a distressed property, fixing it up, and selling for top profit. Keeping it as a rental ends up being a mistake, a backup plan, or a last resort for many people. But is keeping a property as a rental always a bad thing?

Regardless of how you come about owning a piece of property, there are a few things to keep in mind when considering whether you should keep it as a rental or not..."

Image by Teemu008 from Palatine, Illinois via Wikimedia Commons.

The Current State Of The Housing Market

"The Dow Jones Industrial Average was down 19 basis points in early afternoon trading on Friday. The movement came at the end of a tough week for investors as the market retreated from all-time highs just in time to kick off earnings season.

Wells Fargo was the highlight of the earnings calendar this morning, releasing second-quarter results before the opening bell..."

Image via Twitter/DowJones

Using Your Home To Avoid Debt

"I have plenty of experience going into debt. I've spent over half my life paying down a mortgage. I've taken out more than one home equity loan and have made more than my share of car payments. Have I ever been debt-free? Yes, for the first 18 years of my life. But now that I'm approaching retirement, I am nearing that state of equanimity once again. So I know how to get in and also how to get out.

There are plenty of ways to dig yourself deeper into the hole. For most of us, these are the top five debt traps..."

Image by Catherine Scott via Wikimedia Commons.

A Reverse Mortgage Could Help In The Long-Run

"Interest has increased in recent years about whether reverse mortgages are a practical way to supplement retirement income. In a reverse mortgage, a lender makes payments to you based on a percentage of your home's appraised value..."

Image via Wikimedia Commons.

Why You Can Be Patient In Buying A Home

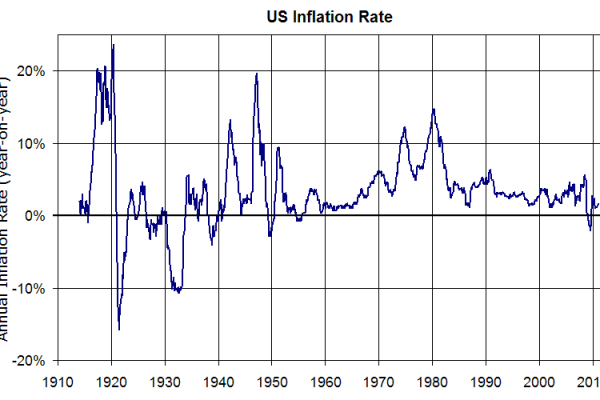

"While 30-year mortgage rates are not quite as low as they were during the first half of 2013, the current average rate of 4.14% is still very low on a historic level. In fact, before the mortgage crisis hit, we had never seen rates this low.

Despite the attractive rates, you don't need to be in too much of a rush to buy right now. Despite what some of the recent news headlines might have you believe, I don't think the low rates are going anywhere anytime soon. Here are three reasons why I think you'll be able to take your time getting ready to buy a home..."

Image by Tommycie via Wikimedia Commons.

Important Statistics To Know When Searching For A House

"Buying a new home can be quite the undertaking, and in many ways, it's a numbers game.

Here are five stats, numbers and percentages you'll need to be familiar with - to give you that winning edge..."

Image by Infrogmation of New Orleans via Wikimedia Commons.

It Is A Smart Investment To Own Your Home

"According to a recent Gallup poll, more Americans are beginning to view real estate as a viable long-term investment. Thirty percent of those surveyed early last month took this view, up from 25% just a year ago. Gallup credited an improving housing market as being the chief driver of the change in popular opinion on this matter..."

Image by Dieter Karner via Wikimedia Commons.